Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

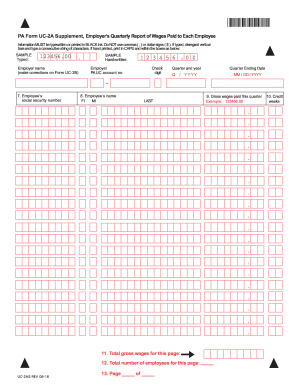

What is pennsylvania form uc 2a?

The Pennsylvania Form UC-2A, also known as the Employer's Quarterly Report of Wages Paid, is a document used by Pennsylvania employers to report wages and employment information of their employees on a quarterly basis. This form is submitted to the Pennsylvania Department of Labor and Industry and helps determine eligibility for unemployment compensation benefits.

Who is required to file pennsylvania form uc 2a?

In Pennsylvania, employers are required to file Form UC-2A, Employer's Quarterly Reconciliation of Unemployment Compensation Tax. This form is used to report wages paid to employees and reconcile the total unemployment compensation taxable wages reported for the quarter.

How to fill out pennsylvania form uc 2a?

To fill out Pennsylvania Form UC-2A (Employer's Quarterly Report of Wages Paid), follow these steps:

1. Obtain the form: You can download a copy of the form from the Pennsylvania Department of Labor & Industry website or contact the department to request a printed copy.

2. Provide basic information: At the top of the form, enter your company's name, address, and employer identification number (EIN). You will also need to indicate the quarter and year being reported.

3. Report taxable wages: In the "Quarterly Totals" section, report the total amount of taxable wages paid during the quarter. These wages include salaries, wages, commissions, tips, and other compensation subject to Pennsylvania Unemployment Compensation Tax.

4. Breakdown by type of wages: In the "Quarterly Totals" section, you will need to break down the taxable wages by type. The types include Regular Pay, Overtime Pay, Vacation/Holiday Pay, Severance Pay, Bonuses, Commissions/Tips, and All Other.

5. Report the number of employees: In the same "Quarterly Totals" section, report the number of employees employed by your company during the quarter. This includes full-time, part-time, and temporary employees.

6. Calculate employee contributions: Calculate the total amount of employee contributions for Pennsylvania Unemployment Compensation Tax. This is 0.06% of each employee's taxable wages, up to the taxable wage base limit.

7. Calculate employer contributions: Calculate the total amount of employer contributions for Pennsylvania Unemployment Compensation Tax. This is 0.06% of each employee's taxable wages, up to the taxable wage base limit.

8. Summarize and sign: Review all the information provided, make sure it is accurate, and sign and date the form.

9. Submit the form: Mail the completed Form UC-2A along with any payment due (if applicable) to the address provided on the form. Make sure to keep a copy for your records.

It is recommended to consult the UC-2A instructions provided by the Pennsylvania Department of Labor & Industry for further guidance specific to your business situation.

What is the purpose of pennsylvania form uc 2a?

The purpose of Pennsylvania Form UC-2A is to provide employers a way to report their quarterly wage and employment information to the Pennsylvania Department of Labor and Industry. This form is used to calculate and determine the eligibility and the amount of unemployment compensation benefits for individuals who become unemployed. It also helps in tracking and maintaining accurate records of employment and wages for the administration of the Unemployment Compensation Law.

What information must be reported on pennsylvania form uc 2a?

Information that must be reported on Pennsylvania Form UC-2A includes:

1. Employer Information: Name, address, and Employer Account Number (EAN) of the company filing the report.

2. Quarterly Wage Information: Total wages paid by the employer during the quarter being reported, including any taxable fringe benefits. The wages should be reported separately for each employee.

3. Employment Information: Total number of employees employed during the quarter and the average number of employees per pay period.

4. Gross Payroll Information: Total gross payroll paid during the quarter for all employees.

5. Unemployment Compensation Contributions (Taxable Payroll): The amount of taxable payroll on which unemployment compensation contributions are due. This includes wages paid to employees up to the taxable wage base, which is $10,000 per employee in Pennsylvania for the 2021 tax year.

6. Unemployment Compensation Tax: The amount of unemployment compensation tax due and payable for the quarter. This is calculated based on the contribution rate assigned to the employer, which varies depending on the employer's history of unemployment claims.

Note: The above information is a general overview and may not be complete or up-to-date. It is recommended to consult the official Pennsylvania Department of Labor & Industry website or a tax professional for specific and accurate information regarding Form UC-2A reporting requirements.

What is the penalty for the late filing of pennsylvania form uc 2a?

According to the Pennsylvania Department of Labor and Industry, the penalty for the late filing of Form UC-2A is $25 for each week that the report is late, up to a maximum of $250. Additionally, there may be interest charges added if the payment is not made in a timely manner.

How do I complete pennsylvania form uc 2a online?

Completing and signing uc2a form online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out the pa form uc 2a form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign pa uc 2a quarterly and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit pa uc 2a on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as uc 2a form. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.